-

Name of company

- Owl.co

-

When was the company incorporated?

- Company was founded on August 2018

-

Who are the founders of the company?

- Sean Merat, Sohrab Merat, Ahid Mirjalili

-

How did the idea for the company (or project) come about?

- Though not specified how the company exactly came to be, Owl.co aims to mitigate false insurance claims while making sure value goes to those who truly need it, so that in the end no one has to pay for another's fraudulant behaviour.

-

How is the company funded? How much funding have they received?

- From various investors and business deals, Owl.co has gained a total of $39,000,000.00 dollars in funding.

-

What specific financial problem is the company or project trying to solve?

- With a system based on knowing your customer, this company will compile non biased data on the client to detect signs of inconsistencies and fraud.

-

Who is the company's intended customer? Is there any information about the market size of this set of customers?

- Financial institutions, Insurance Providers. Ex. The Toronto Stock Exchange, Fairstone, and top 10 banks / insurers across North America

-

What solution does this company offer that their competitors do not or cannot offer? (What is the unfair advantage they utilize?)

- Owl.co's technology specializes in aggregating customer data in order to determine credit worthiness and mitigate any signs of fraud.

-

Which technologies are they currently using, and how are they implementing them? (This may take a little bit of sleuthing–– you may want to search the company’s engineering blog or use sites like Stackshare to find this information.)

- They are using artificial intelligence to compile data for their client at a fraction of time to assist any verification processes.

-

What domain of the financial industry is the company in?

- The domain Owl.co works is within the Regtech & Insurtech field.

-

What have been the major trends and innovations of this domain over the last 5-10 years?

- This company was able to save cost by being able to sort through massive amounts of data at a fraction of the time. With the advancements in machine learning and automation, efficiency in data processing has exponentially been increased thus servicing customers and apprehending criminals has never been any faster.

-

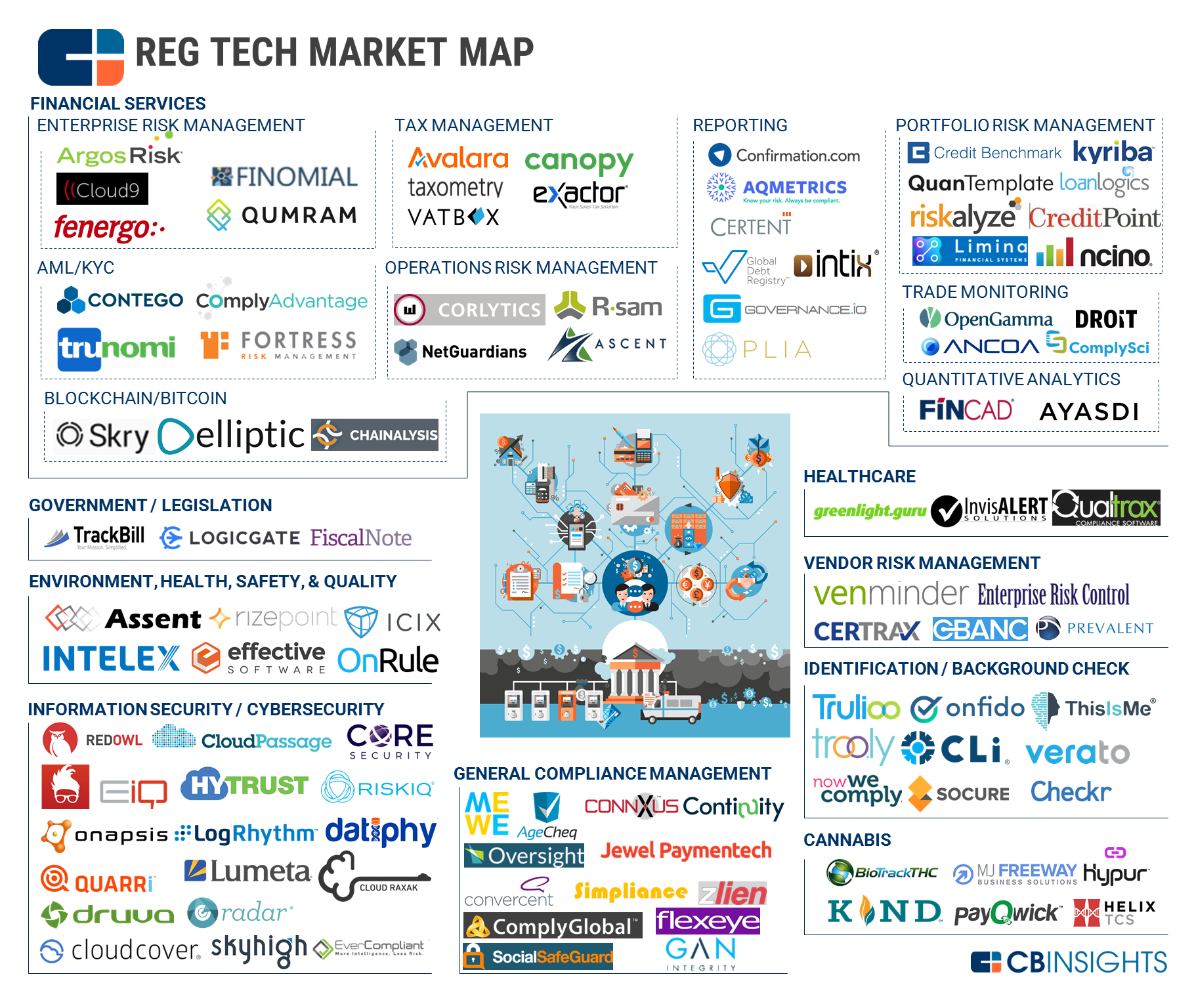

What are the other major companies in this domain?

- Various Companies in the Regtech Sector include: Galvanize, Secure Key, Solink, Trulioo,

Verafin, Agreement EXPRESS, iComply, PeerLedger, PitchPoint solutions, TIER1 Financial Solutions.

-

What has been the business impact of this company so far?

- Thanks to their automated software, Owl.co has been able to reduce customer

background checks what from would be hours into minutes with automated software thus increasing efficiency and reducing costs. -

What are some of the core metrics that companies in this domain use to measure success? How is your company performing, based on these metrics?

- When it comes to Regulatory Compliance, key factors of determining success would be: cost-reduction, time-efficiency, data-protection,and performance-success.

-

How is your company performing relative to competitors in the same domain?

- As it is still an emerging company founded in 2018, Owl.co has already amassed $39,000,000.00 dollars in funding over the four years since the start of their operations. Compared to other similar companies, Owl.co is still a newer contender on the field operating independently while older companies like Galvanize and Secure Key have already signed aquisition contracts with larger companies and merged. And a larger fraud detection company Verafin continues to be one of the more well known enterprises in the regtech environment with it's nineteen years of operational experience and $454,000,000.00 dollars in total funding.

-

If you were to advise the company, what products or services would you suggest they offer? (This could be something that a competitor offers, or use your imagination!)

- Owl.co is a software based company, they offer their clients the technology to automatically aggregate customer data to swiftly perform background checks to detect signs of any inconsistencies and/or fraudulant behaviour at a fraction of the time and energy compared to older traditional methods.

-

Why do you think that offering this product or service would benefit the company?

- What makes Owl.co services so valuable is that they can offer fianancial institution a convenient solution to quickly perform: Automated customer onboarding; Instant Know Your Customer & Anti-Money Laundering; Fraud Detection. With such benefitial technology on hand, this provides the client the resources to instantly and efficiently handle regulatory measures at a lower cost.

-

What technologies would this additional product or service utilize?

- Hardware for company servers to run the service on, Automated data scanning and processing, Machine learning.

-

Why are these technologies appropriate for your solution?

- Protecting the people'safety is part of regulatory technology's purpose. As a service that provides the ability to collect and process large amounts of data in a short time span, Owl.co prides themselves on their capacity to catch fraud perpetrators and money laundering schemes through automation based on a non-biased criteria: ie. Age, Race, Gender, Background. This will drastically reduce human error as the analysis will be based on collecting past evident data and compiling it into availible information within a matter of minutes.

- My chosen field will be in Regulation Technology (Regtech).

Regtech is the application of software and technology

to help financial institutions efficiently manage regulatory demands.

Ex. The compliance of: (regulations, laws, guidelines); protection of

(sensitive information and human safety); and security from:

(money laundering, data breaches, and insurance fraud).